State And Local Tax Refund Worksheet

If you itemized deductions on your federal return in the year you received the refund all or a portion of that refund may be taxable. E Maryland State House is the oldest state capitol in continuous legislative use and is the only state house to ever have served as the nations capitol.

2020 Instructions For Schedule H 2020 Internal Revenue Service

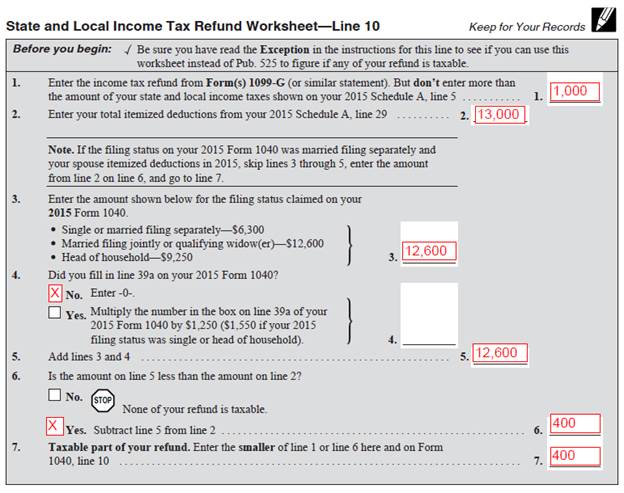

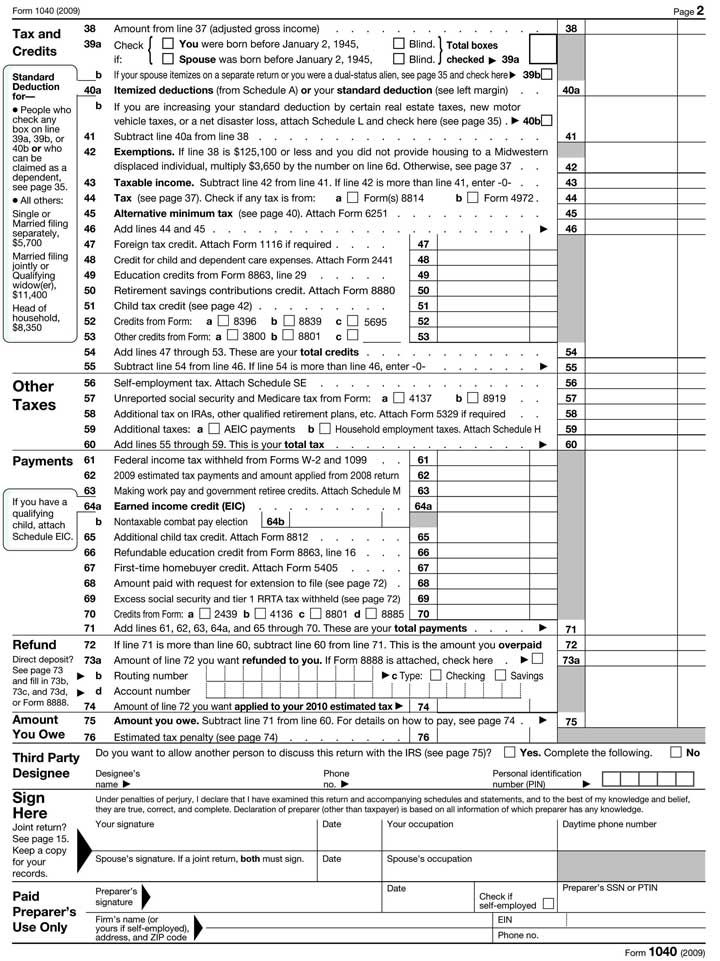

A line 5 less state and local refunds Worksheet 3 - Difference Worksheet 4 - State and Local Income Tax Refund Worksheet Worksheet 5 - State and Local Income Tax and General State Sales Tax Computation Keep for your records 1 Enter the total amount from Schedule A line 5 1.

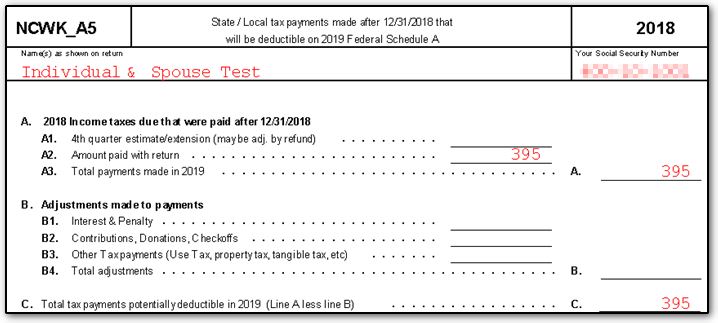

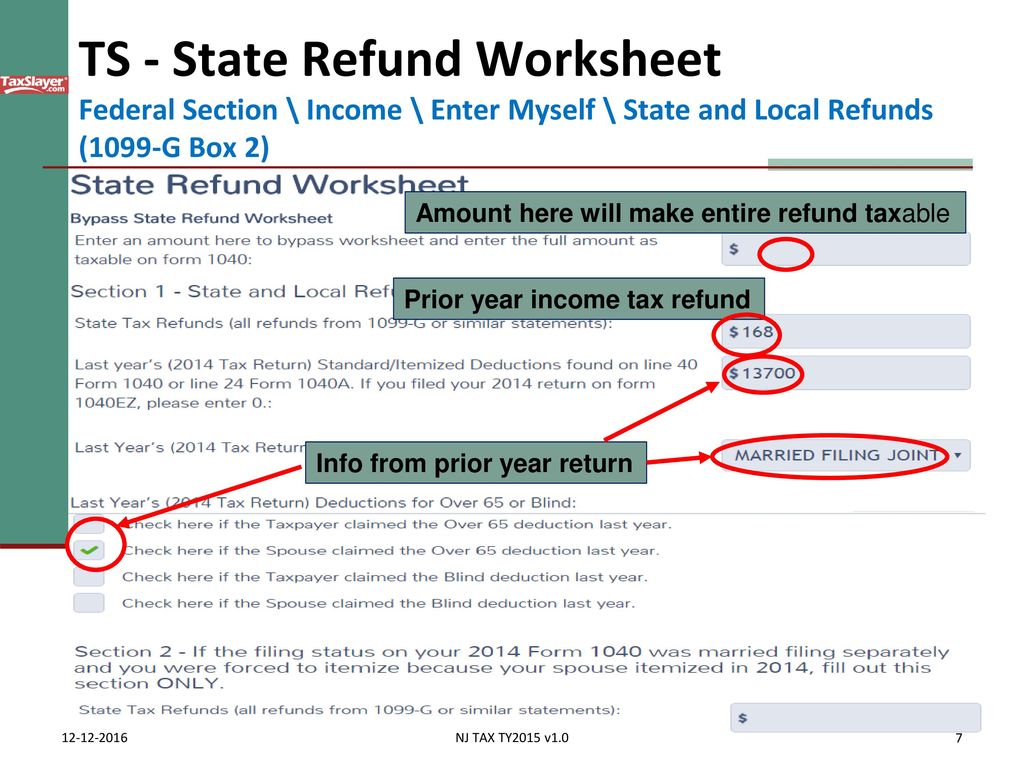

State and local tax refund worksheet. Todays announcement does not affect state tax refunds received in 2018 for tax returns currently being filed. State and Local Refund Worksheet TaxSlayer Navigation. In Drake15 and prior this worksheet is titled WK_REFXX XX being the last 2 digits of the year.

Choose Setup 1040 Individual click the Other Return Options button click the Other tab and mark the Print Tax Refund Worksheet if applicable box. Calculate and view the return. Both will guide taxpayers in determining whether their refund is taxable or not.

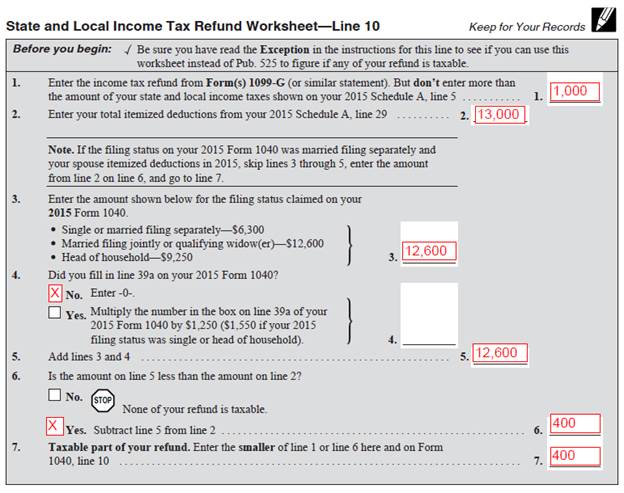

State and Local Income Tax Refund Worksheet. 525 to figure if any of your refund is taxable. Enter the income tax refund from Forms 1099-G or similar statement.

For more information on potential tax-exemption of these refunds taxpayers should consult Form 1040 Instructions State and Local Income Tax Refund Worksheet see Page 23 andor Publication 525s Itemized Deduction Recoveries section see Page 23. Worksheet instead of Pub. For most people its all taxable or none and the worksheet is seldom needed.

Or Keyword G Use this worksheet only if the taxpayer itemized deductions last year claiming state income taxes as a deduction and received a state or local income tax refund. Worksheet 2 - 2015 Sch. Also review the State and Local Income Tax Refund Worksheet found in the Instructions to Schedule A to determine the taxable portion of the refund.

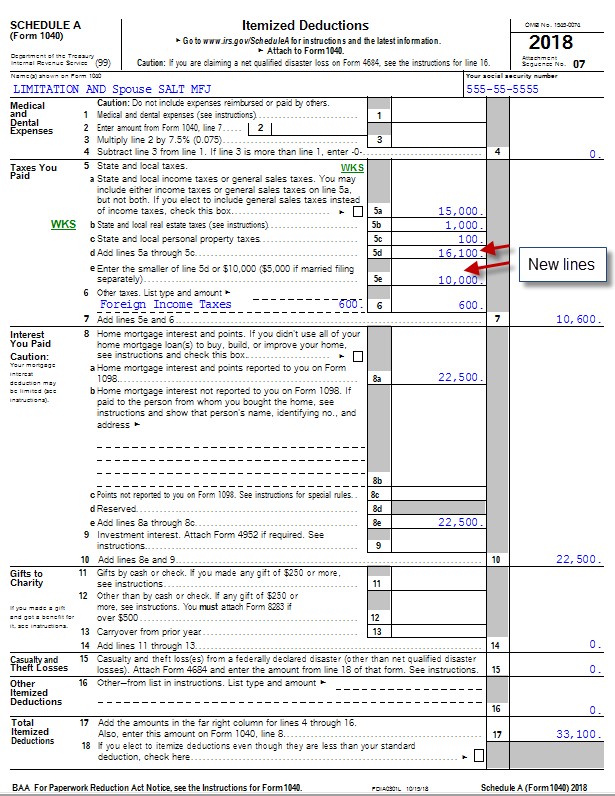

The Tax Cuts and Jobs Act TCJA enacted in December 2017 limited the itemized deduction for state and local taxes to 5000 for a married person filing a separate return and 10000 for all other tax filers. However when certain exceptions exist the taxpayer may be required to treat the state or local tax refund as an Itemized Deduction Recovery in Publication 525 instead of using the worksheet. 1017 Taxable state income tax refund Sch 1 line 1 TSO.

If you did not itemize your deductions or elected to deduct the state and local sales tax rather than the state and local income tax on your 2019 return you do not need to complete the worksheet. Ad Download over 20000 K-8 worksheets covering math reading social studies and more. The Tax Refund Worksheet calculates based on the data you enter in this section and if you do the following for all of your clients.

Peter Franchot Comptroller Scan to check your refund VWDWXVDIWHUOLQJ MARYLAND 2019 STATE LOCAL TAX FORMS INSTRUCTIONS. The State and local tax refund worksheet determines how much of your state refund from last year received in the current tax year is taxable on your federal return. Enter the income tax refund from Form s 1099G or similar statement.

Local And State Tax Refund Taxable. 525 to figure if any of your refund is taxable. Look for a worksheet named Wks CY Refunds 20XX State and Local Income Tax Refund Worksheet and review it for information on whether or not there will be a taxable event.

Even if your client completed Schedule A for the prior year refunds of state taxes are not taxable unless the taxpayer actually used the itemized deductions rather than the standard deduction. Discover learning games guided lessons and other interactive activities for children. Ad Download over 20000 K-8 worksheets covering math reading social studies and more.

State local income tax refunds. State and Local Income Tax Refund WorksheetSchedule 1 Line 10 Be sure you have read the Exception in the instructions for this line to see if you can use this worksheet instead of Pub. Discover learning games guided lessons and other interactive activities for children.

But there are certain circumstances when only a portion of the refund is taxable. If you claimed the state or local income taxes you paid as an itemized deduction on last years return usually your state or local refund is taxable. If return is rolled over from prior year the amount of allowable itemized deductions amount actually used is automatically rolled over and entered on line 2 of the Form 1040 Ln 10 - Tax Refund worksheet.

Go to the 99G screen and enter information in the Additional Box 2 Information fields. TS Income State and Local Refunds Bypass worksheet line. Be sure you have read the Exception in the instructions for this line to see if you can use this.

You might receive Form 1099-G reporting a state or local income tax refund. If so that doesnt mean your refund is automatically taxable. But do not enter more than.

Federal SectionIncomeForm 1099-G Box 2. A worksheet recomputed using original Sch.

1040 State Taxes On Wks Carry Schedulea

Irs Ez Form 2017 Unique State Tax Refund Worksheet Item B Fresh Irs 19 Form Image Models Form Ideas

Https Apps Irs Gov App Vita Content Globalmedia State And Local Refund Worksheet 4012 Pdf

Tax Information Career Training Usa Interexchange

Irs Ez Form 2017 Unique State Tax Refund Worksheet Item B Fresh Irs 19 Form Image Models Form Ideas

Spreadsheet Based Form 1040 Available At No Cost For 2013 Tax Year Accountingweb

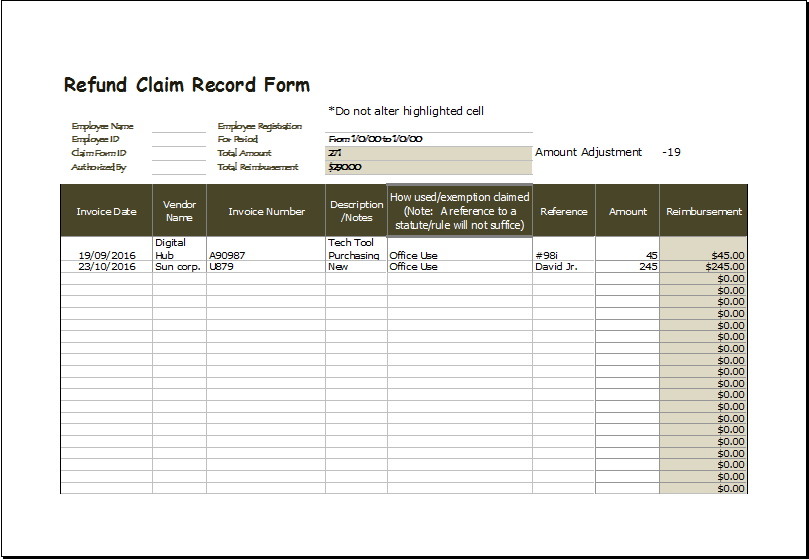

Refund Claim Record Form Excel Template Excel Templates

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

1040 State Taxes On Wks Carry Schedulea

State Income Tax Refund Alimony Ppt Download

/ScreenShot2021-02-05at7.25.53PM-30d1f6f9936c4f7aa8c22c5f33269801.png)

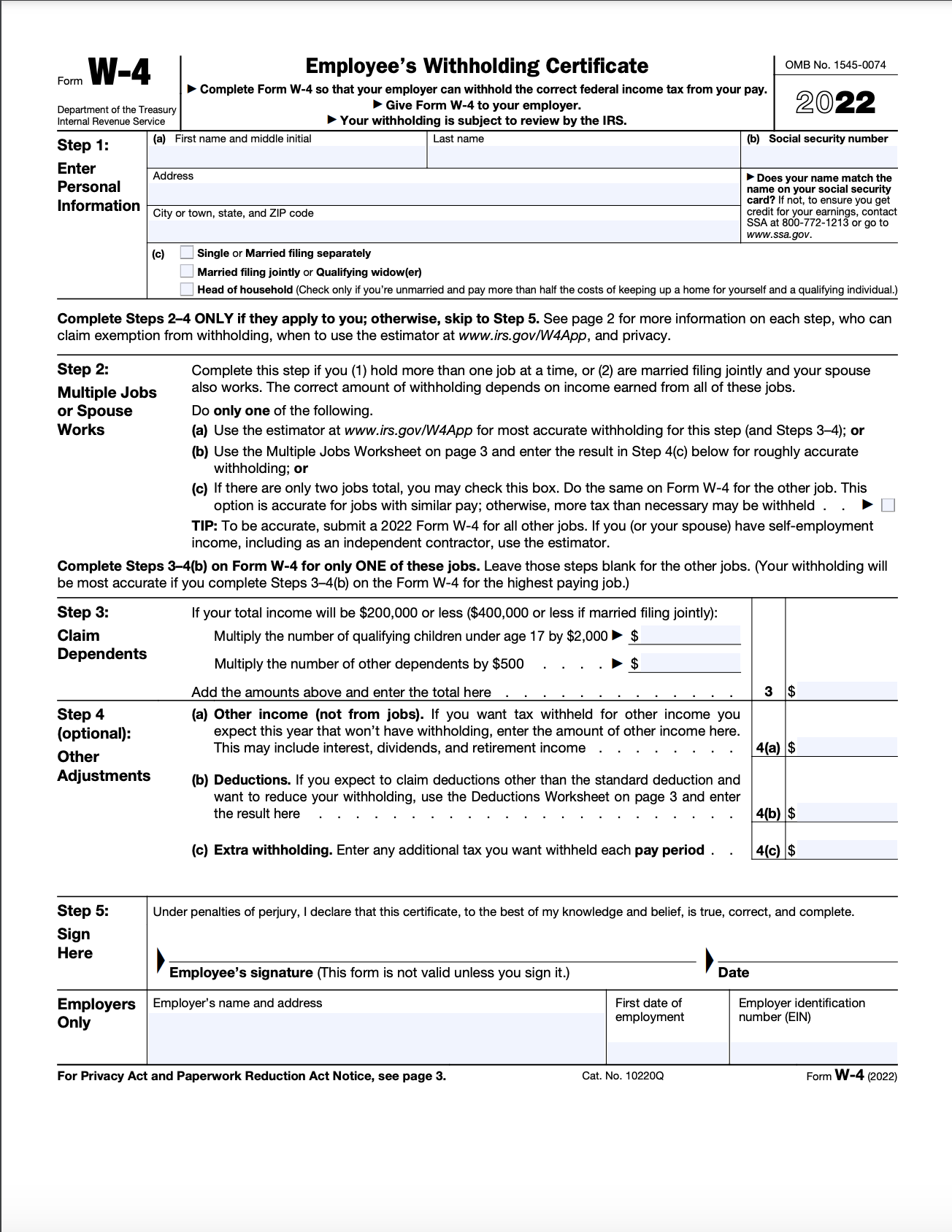

W 4 Form How To Fill It Out In 2021

Pa Municipality Tax Return Out Of State Credit For School Tax

Odr 1099 G Question And Answers Oregon Association Of Tax Consultants

Qualified Dividends And Capital Gain Tax Worksheet 2019 Fill Online Printable Fillable Blank Pdffiller

If I Am Being Told To Check This Entry And It Says

Worksheet For Completing The Sales And Use Tax Return Form 01 117

How Tax Reform Affects The State And Local Tax Salt Deduction Tax Pro Center Intuit

0 comments