Pa 40 Gross Compensation Worksheet

Indicate the amount of wages earned in Pennsylvania while you were NOT a resident of Indiana Maryland New Jersey Ohio Virginia or Wisconsin. Enter your PA-taxablecompensation from Box 16 of your 2013 Form s W-2.

1 2 3 Home.

Pa 40 gross compensation worksheet. Wage and Tax Statement so that the department may reconcile the wages to determine if the proper amount of gross compensation income is reported for Pennsylvania personal income tax purposes. Pa direct file will automatically calculate all lines that do not have a text entry box. Printable Pennsylvania state tax forms for the 2020 tax year will be based on income earned between January 1 2020 through December 31 2020.

Gross Compensation PA Taxable Wages 04-2733764 2313070 160423 2527787 106167 2527787 36653 1118 214717 1730976 C D DD. Net change amount of increase or decrease Explain in SECTION III C. Use these fields to force a different amount of taxable military income if desired.

Do not report this amount on your amended PA-40 H. You will be guided through your return including all applicable schedules by selecting Continue after you have completed a form or schedule. Get thousands of teacher-crafted activities that sync up with the school year.

Complete worksheet if you work in an area where the non-resident tax rate exceeds your home resident rate 1. I have a client with one W2 with three withholding for three states listed. PA W-2 RECONCILIATION WORKSHEET PA-40 W-2 RW EX 07-19FI wwwrevenuepagov PA.

If your W-2 does not contain sufficient information in Boxes 12 and 14 to reconcile the federal and Medicare wages on your W-2 to the amount reported as PA wages complete and include the PA-40 W-2 RW Reconciliation Worksheet with your return. Please follow the instructions for Payment Options found in the PA-40 Personal Income Tax Return booklet to make a payment with your amended PA-40. Use these fields only when there are two part-year states attached and Pennsylvania is the nonresident state.

However the Keystone state is one of only seven states that have a simplified flat tax so the two-page PA-40 is easier to fill out than most other states. I keep getting a warning to delete the extra in the Gross Compensation Worksheet but there is literally no way to do this. 0 0 0 0 TAXPAYER TAXPAYER SPOUSE.

If the result is positive this is the amount you owe with your amended return. Ad The most comprehensive library of free printable worksheets digital games for kids. Wwwrevenuepagov PA-40 W-2 RW 1.

The Schedule W2S column PA compensation from box 16 needs to be manually updated. Complete this worksheet for line 10 on the front of this return if you work in an area where the non-resident tax exceeds your home resident tax rate. Amount of gross compensation income is reported for Pennsylvania personal income tax purposes.

2020 Form Pa-40 instructions - page 11 -. States that require residents to pay a personal income tax each year. PA W-2 Reconciliation Worksheet PA-40 W-2 RW START PA-40 W-2 RW EX 07-19 FI.

An amended return is not filed until the department receives both the amended PA-40 and the Schedule PA-40 X. Form W-2 Wage and Tax Statement so that the department may reconcile the wages to determine if the proper amount of gross com-pensation income is reported for Pennsylvania personal. Ad The most comprehensive library of free printable worksheets digital games for kids.

Donot use Box 1 Federal Wages. Reported on PA-40 Schedule W-2S Wage Statement Summary are not. Gross Compensation as Reported on W-2s.

Turbotax help is no help at all the only way to get any assistance with their mistakes is to pay an extra 50 to be put on hold for an hour before talking with. Subtract Line H from Line G. Original amount or as previously amended B.

If the Military wages Force field is used UltraTax CS updates the Pennsylvania Gross Compensation Worksheet which is used throughout the calculation of the Pennsylvania tax return. Report your PA income taxwithheld from Box 17 of each Form W-2 on Line 13 of yourPA-40. That were reported on your PA-40 Return.

PA-40 W-2 RW Reconciliation Worksheet. Correct amount INCOME Line 1a Gross Compensation. Get thousands of teacher-crafted activities that sync up with the school year.

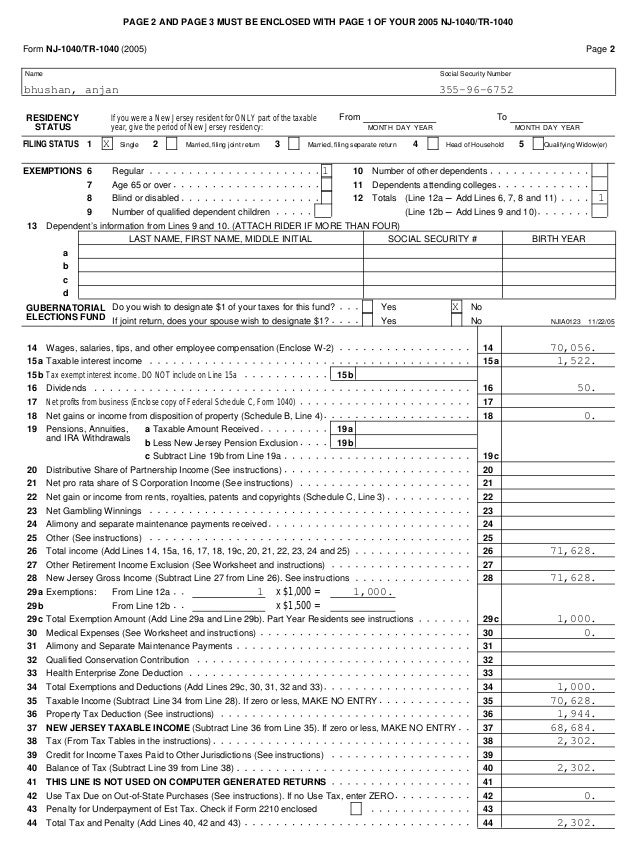

In compensation under IRC Section 409A shown as Code Y in Box 12. On the gross Compensation Worksheet for PA-40 the return is picking up the amounts for all three states that pulled over from the 1040 even though two amounts are listed as other states. Pennsylvania is one of the 41 US.

PA non-resident wages allocated to three states. The Pennsylvania income tax rate for tax year 2020 is 307. PA W-2 RECONCILIATION WORKSHEET PA-40 W-2 RW EX 05-18.

However if such expenses are extensive a PA-40 Schedule C Profit or Loss From Business or Profession may be used in lieu of the PA-40 Schedule UE Allowable Employee Business Expenses provided that the PA wages shown on the W-2 are included on Line 1a Gross Compensation and the expenses from Schedule C are included on Line 1b Unreimbursed Business Expenses. Pennsylvania state income tax Form PA-40 must be postmarked by April 15 2021 in order to avoid penalties and late fees. UltraTax CS puts these amounts on the Pennsylvania Gross Compensation Worksheet on line 1 W-2 Wages and zero out any line 2.

Report your PA compensation and withholding from each2013 Form W-2 from each employer. That you reported on your PA-40 return in these boxes. To claim Tax Forgiveness answer Yes to the question by the.

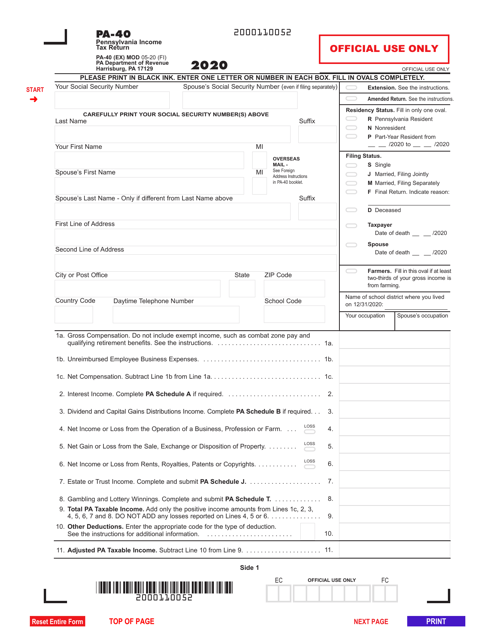

A PA-40 form is the Pennsylvania Department of Revenues official paper form that the states residents use to file state income taxes.

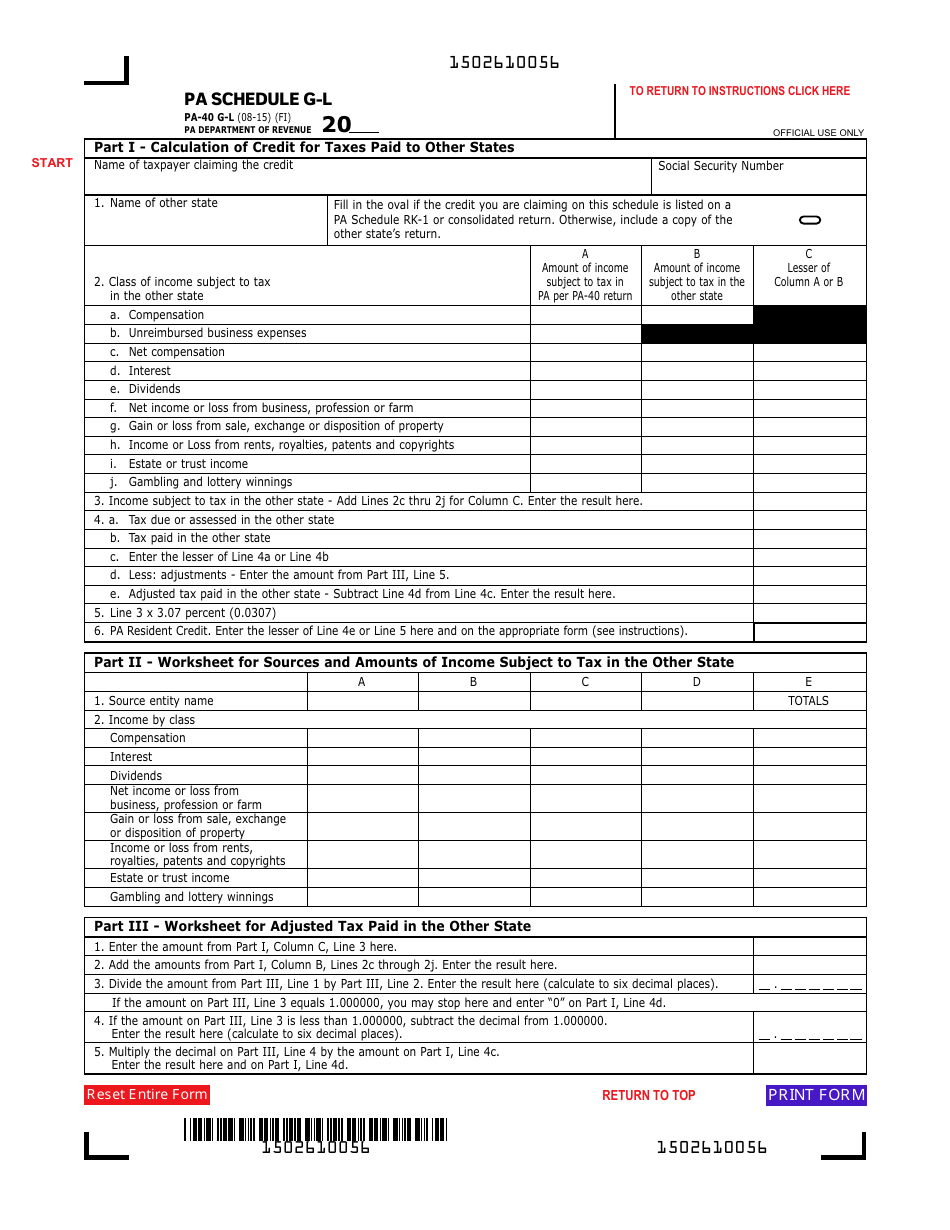

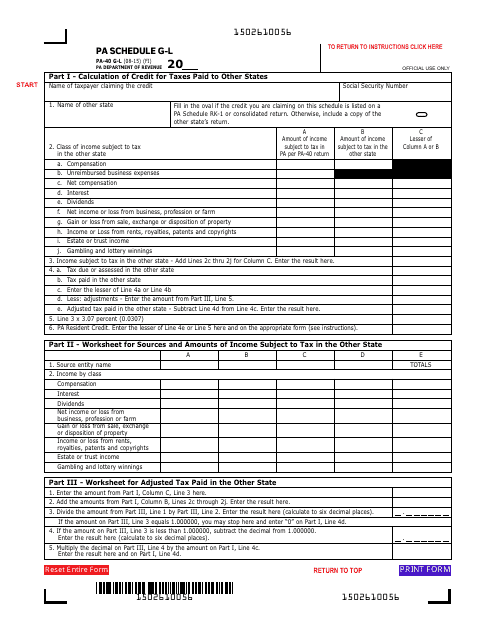

Form Pa 40 Schedule G L Download Fillable Pdf Or Fill Online Resident Credit For Taxes Paid Pennsylvania Templateroller

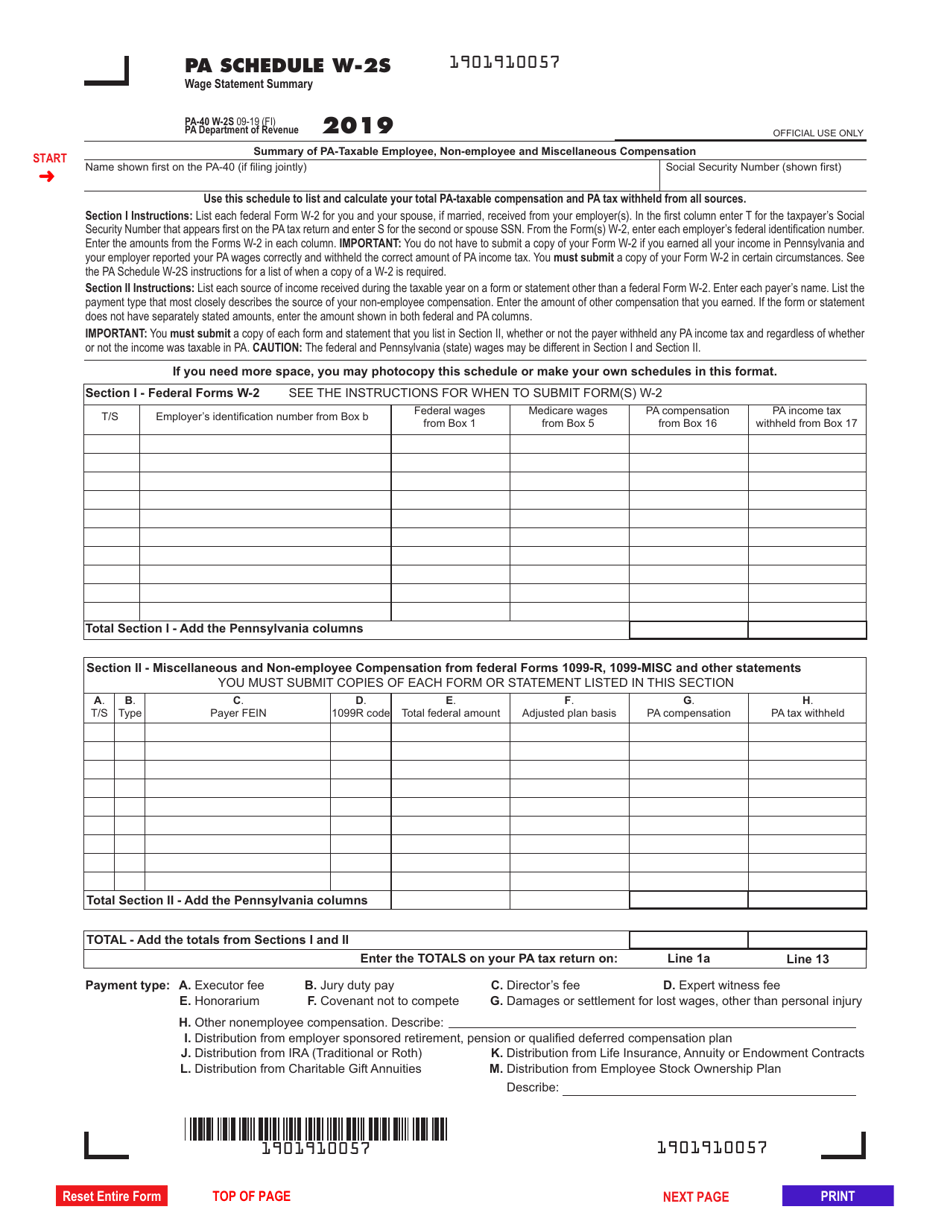

Form Pa 40 Schedule W 2s Download Fillable Pdf Or Fill Online Wage Statement Summary 2019 Pennsylvania Templateroller

Pa 40 2012 Pennsylvania Income Tax Return Free Download

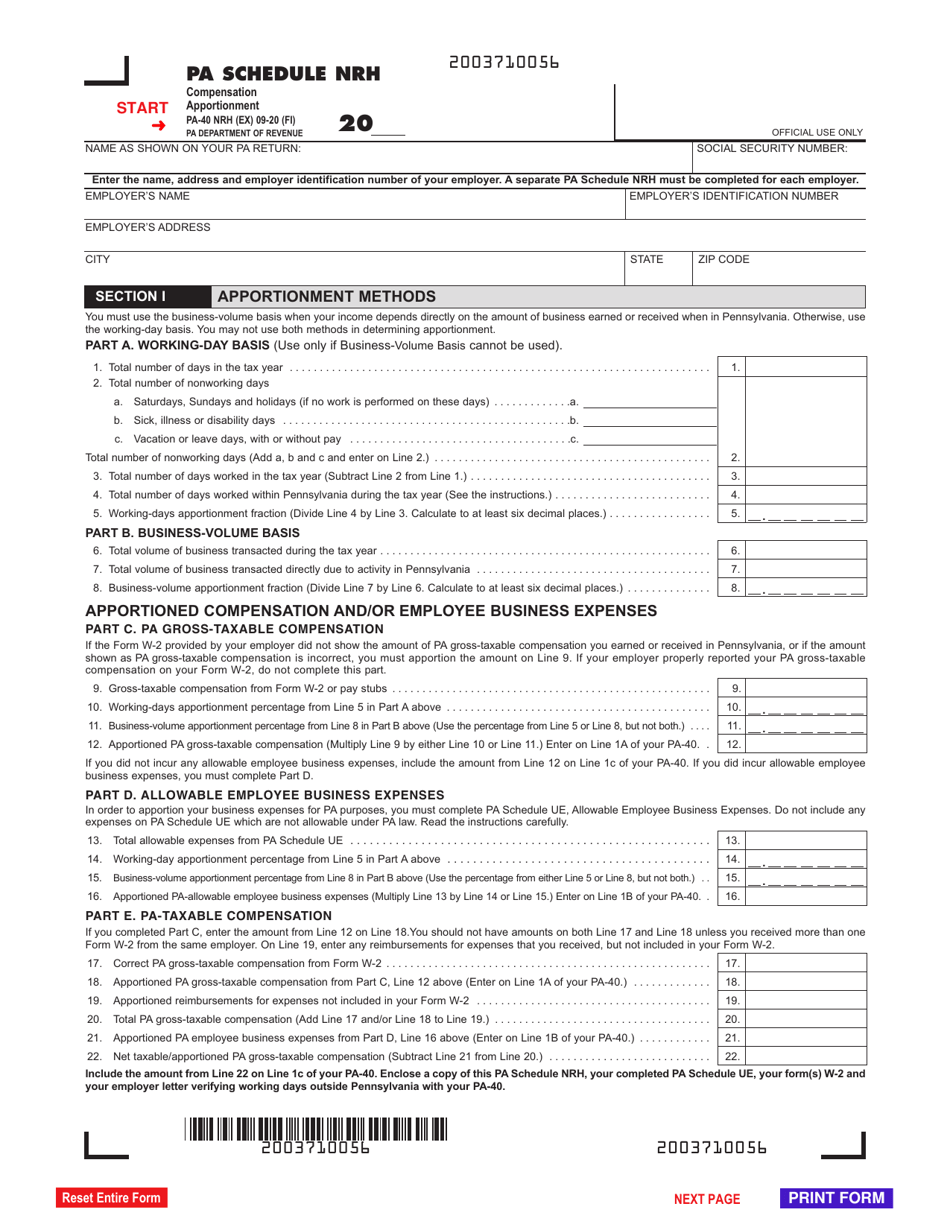

Form Pa 40 Schedule Nrh Download Fillable Pdf Or Fill Online Compensation Apportionment Pennsylvania Templateroller

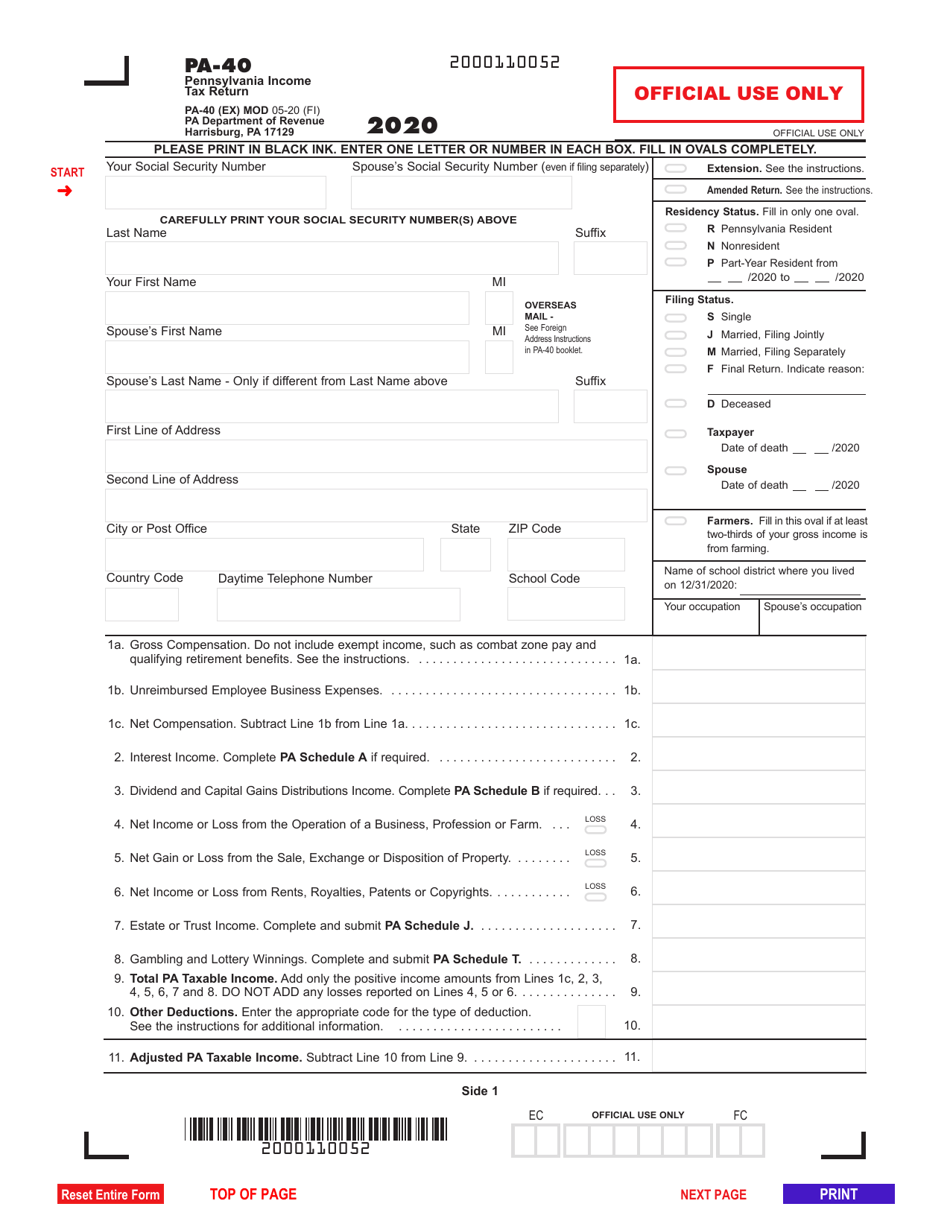

Form Pa 40 Download Fillable Pdf Or Fill Online Pennsylvania Income Tax Return 2020 Pennsylvania Templateroller

Https Www Revenue Pa Gov Formsandpublications Formsforindividuals Pit Documents 2010 2010 Pa 40 Telefile Worksheets Pdf

Https Www Revenue Pa Gov Formsandpublications Formsforindividuals Pit Documents 2016 2016 Pa 40w2s Pdf

Https Www Hampton Pa Org Documentcenter View 1191 Earned Income Tax Return Form

Form Pa 40 Schedule G L Download Fillable Pdf Or Fill Online Resident Credit For Taxes Paid Pennsylvania Templateroller

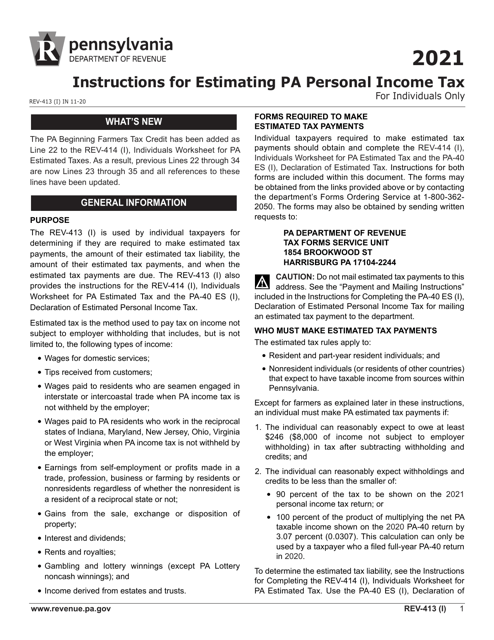

Download Instructions For Form Rev 414 I Pa 40 Es I Pdf 2021 Templateroller

Https Www Hab Inc Com Wp Content Uploads Finalwebdcedfpm Pdf

Form Pa 40 Download Fillable Pdf Or Fill Online Pennsylvania Income Tax Return 2020 Pennsylvania Templateroller

Pa 40 2012 Pennsylvania Income Tax Return Free Download

Pa Schedule W 2s Eliminated Drake20

0 comments