Irs Publication 970 Worksheet

See Publication 970 Worksheet 1-1 to calculate the taxable portion of your non-compensatory pay. If you are a degree candidate at an eligible educational institution go to line 2.

Credit Limit Worksheet Fill Online Printable Fillable Blank Pdffiller

Select a category column heading in the drop down.

Irs publication 970 worksheet. Taxable Scholarship and Fellowship Income 1. Enter the total amount of any scholarship or fellowship grant for 2020. Revisit your personalized earning plan periodically making adjustments for financial or professional changes.

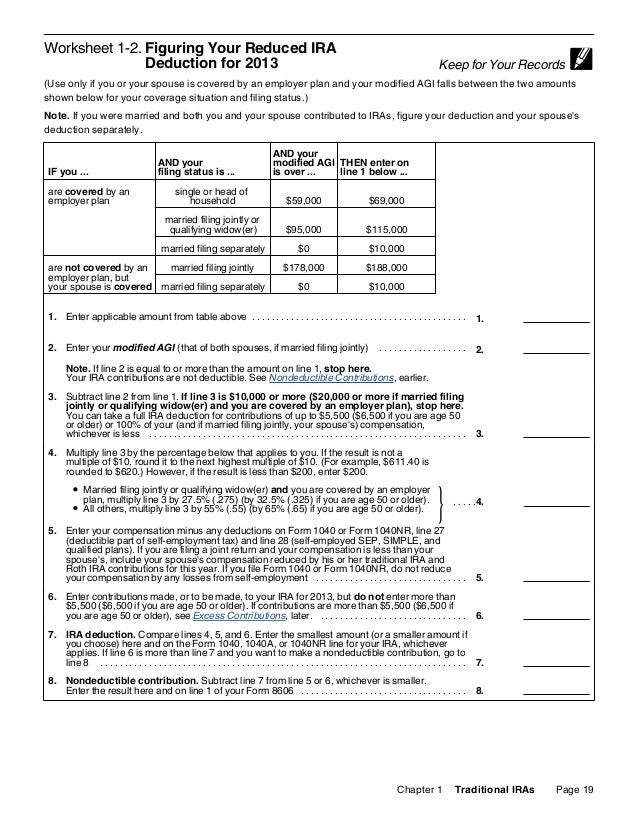

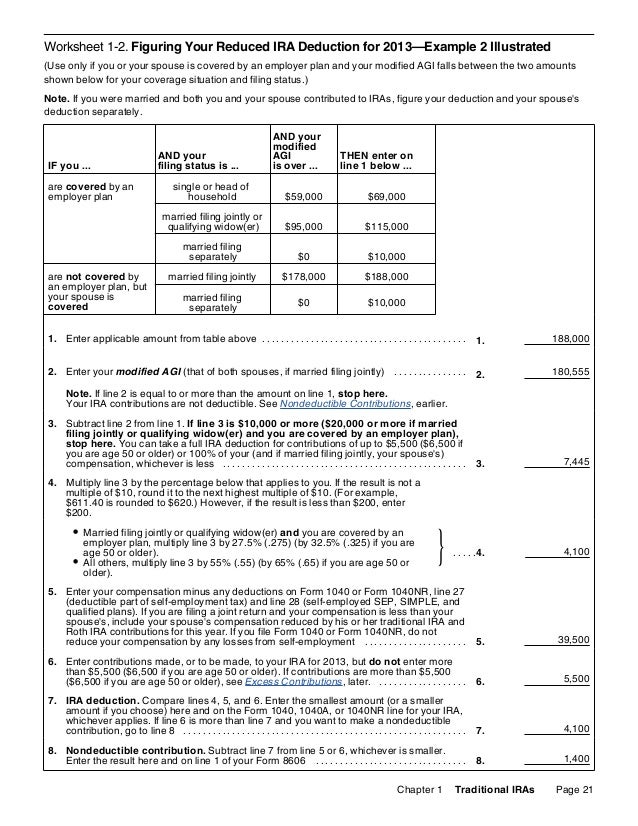

Ad The most comprehensive library of free printable worksheets digital games for kids. In determining taxable income the following table and worksheet reproduced from IRS Publication 970 can serve as a guide. Click on column heading to sort the list.

Please remember that calendar year refers to January 1 - December 31. Use IRS Worksheet 7-3 Coverdell ESA -- Taxable Distributions and Basis. Refer to the text for complete details.

Wwwirsgov your accountant or the Federal Financial Aid Information Line at 18004FEDAID or review IRS publication 970. See IRS Publication 970 for additional information regarding 1099-Qs. TO HAVE A CAREER THAT.

Get thousands of teacher-crafted activities that sync up with the school year. You will receive a Form 1099-Q from each of the state programs from which you received a QTP distribution in the tax year. Ad The most comprehensive library of free printable worksheets digital games for kids.

See IRS Publication 970 Tax Benefits for Education pages 56-60 for more information. If you received aid for the 2016-17 academic year. See Amount of scholarship or fellowship grant in Publication 970.

Table 1-1 Taxability of Scholarship and Fellowship Payments. To enter data from your Form 1099-Q Payments from Qualified Education Program. Internal Revenue Service Publication 970 Cat.

Get thousands of teacher-crafted activities that sync up with the school year. Information will flow to worksheet QEPD and if taxable to line 21 of Form 1040. You may be able to enter information on forms before saving or printing.

Certain training and education costs qualify for tax deductions. IRS Publication 970 includes a worksheet to help you calculate any tax responsibilities or benefits IRS Publication 970. Do not rely on this table alone.

The account number line 12 is for the Preparer record and not used in the calculation of the return. Enter a term in the Find Box. Click on the product number in each row to viewdownload.

You can determine your basis in this Coverdell ESA as of December 31 2004 by adding to the basis as of the end of that year any contributions made to that account after the year of the distribution and before 2005. You can find this worksheet at the end of Chapter 7 in IRS Publication 970 2010 Tax Benefits for Education Using the worksheet can reduce the opportunities for making mathematical mistakes in calculating your basis or the difference between your contributions and your qualified tuition expenses. For years after 2001 you can find that amount by using the ending basis from Worksheet 7-3 in Publication 970 for that year.

Note any costs to keep track of your expenses. IRSgov English IRSgovSpanish Espaol IRSgovChinese IRSgovKorean . For more information refer to IRS Publication 970.

Basically you will subtract your qualified education expenses from your non-compensatory pay and only report as taxable income any excess non-compensatory pay. IRS Publication 970 is a document published by the Internal Revenue Service IRS that provides information on tax benefits available to students and families saving or paying for college. Taxes on Student Aid and Loan Forgiveness Scholarships fellowships and grants that you received and that are reported on the 1098-T may need to be reported as taxable income in certain circumstances but are often tax-free.

See IRS Publication 970 for information 6. The Tax Reform Act of 1997 provided taxpayersstudents with Hope Scholarship and Lifetime Learning tax credit opportunities. IF you use the payment for.

25221V Tax Benefits for Education For use in preparing 2020 Returns Get forms and other information faster and easier at.

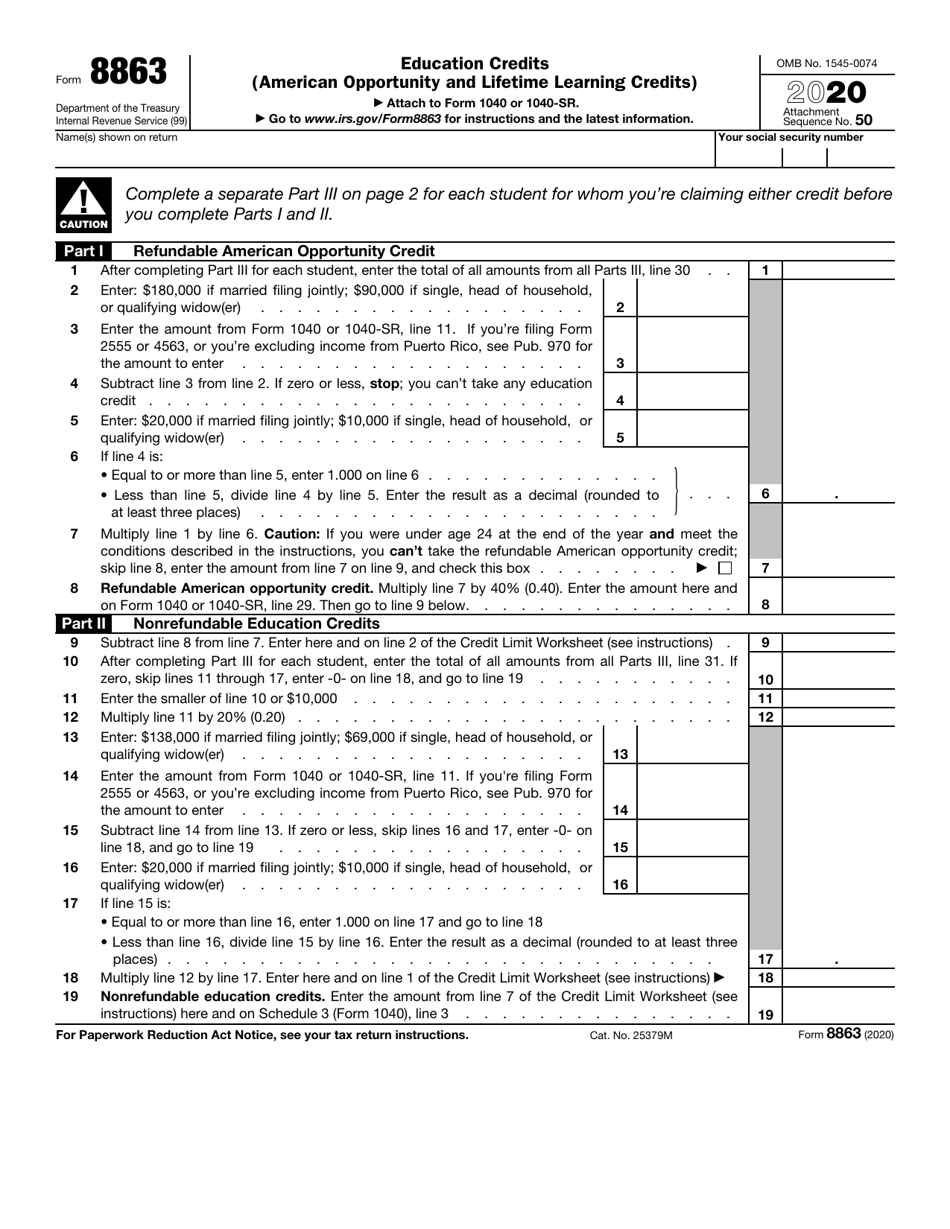

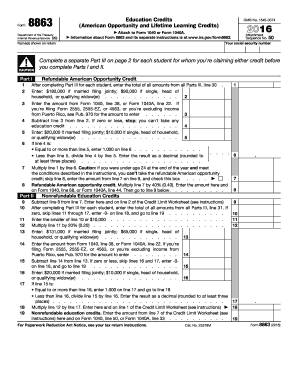

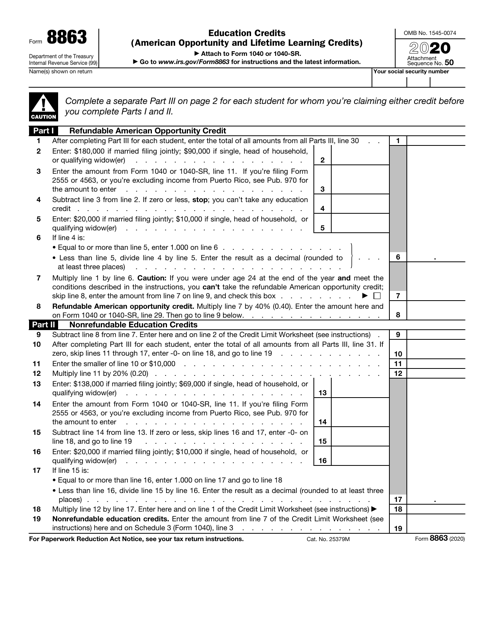

Form 8863 Instructions Information On The Education Credit Form

Irs Form 8863 Download Fillable Pdf Or Fill Online Education Credits American Opportunity And Lifetime Learning Credits 2020 Templateroller

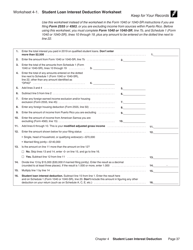

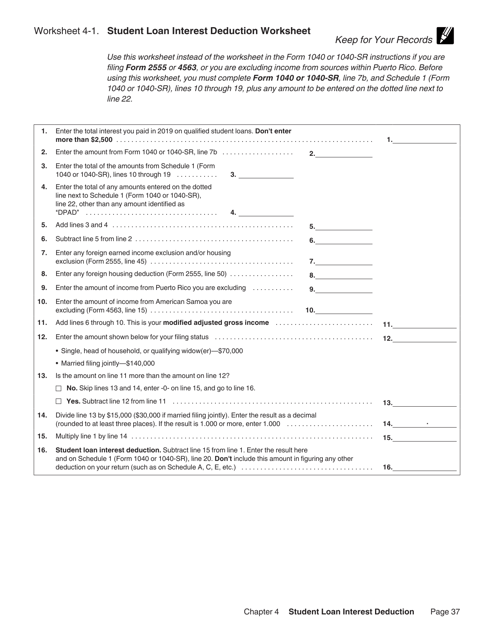

Student Loan Interest Deduction Worksheet Publication 970 Download Printable Pdf Templateroller

Student Loan Interest Deduction Worksheet Fill Online Printable Fillable Blank Pdffiller

Student Loan Interest Deduction Worksheet Line 33

Credit Limit Worksheet Fill Online Printable Fillable Blank Pdffiller

Eic Table 2015 Wild Country Fine Arts

Publication 970 2018 Tax Benefits For Education Internal Revenue Service Education Cover Pics College Loans

Irs Form 8863 Download Fillable Pdf Or Fill Online Education Credits American Opportunity And Lifetime Learning Credits 2020 Templateroller

Student Loan Interest Deduction Worksheet Publication 970 Download Printable Pdf Templateroller

Student Loan Interest Deduction Worksheet 2020 Fill Online Printable Fillable Blank Pdffiller

Publication 970 2018 Tax Benefits For Education Internal Revenue Service Internal Revenue Service Education College Loans

Publication 590 A 2018 Contributions To Individual Retirement Arrangements Iras Internal Revenue Servic Social Security Benefits Irs Tax Forms Tax Forms

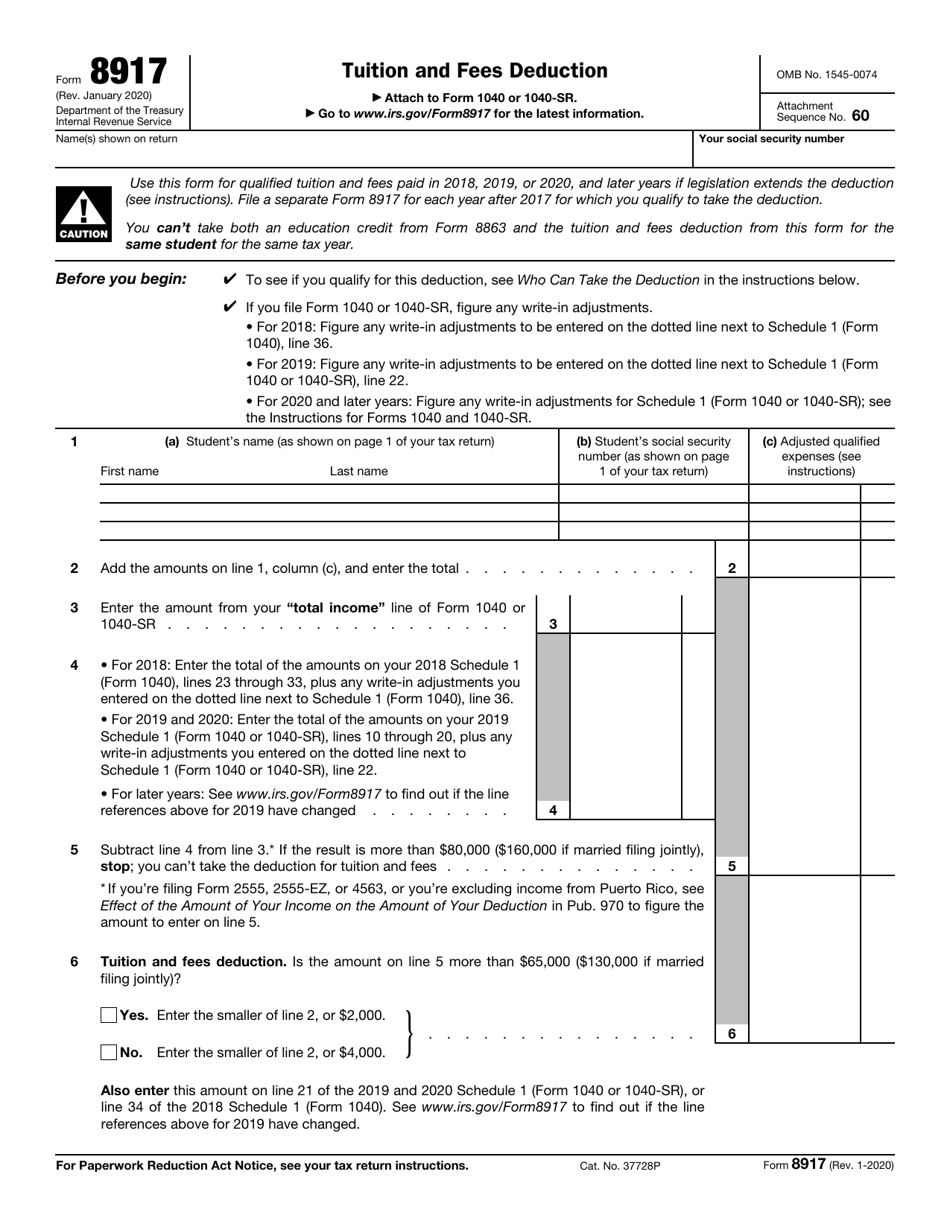

Irs Form 8917 Download Fillable Pdf Or Fill Online Tuition And Fees Deduction Templateroller

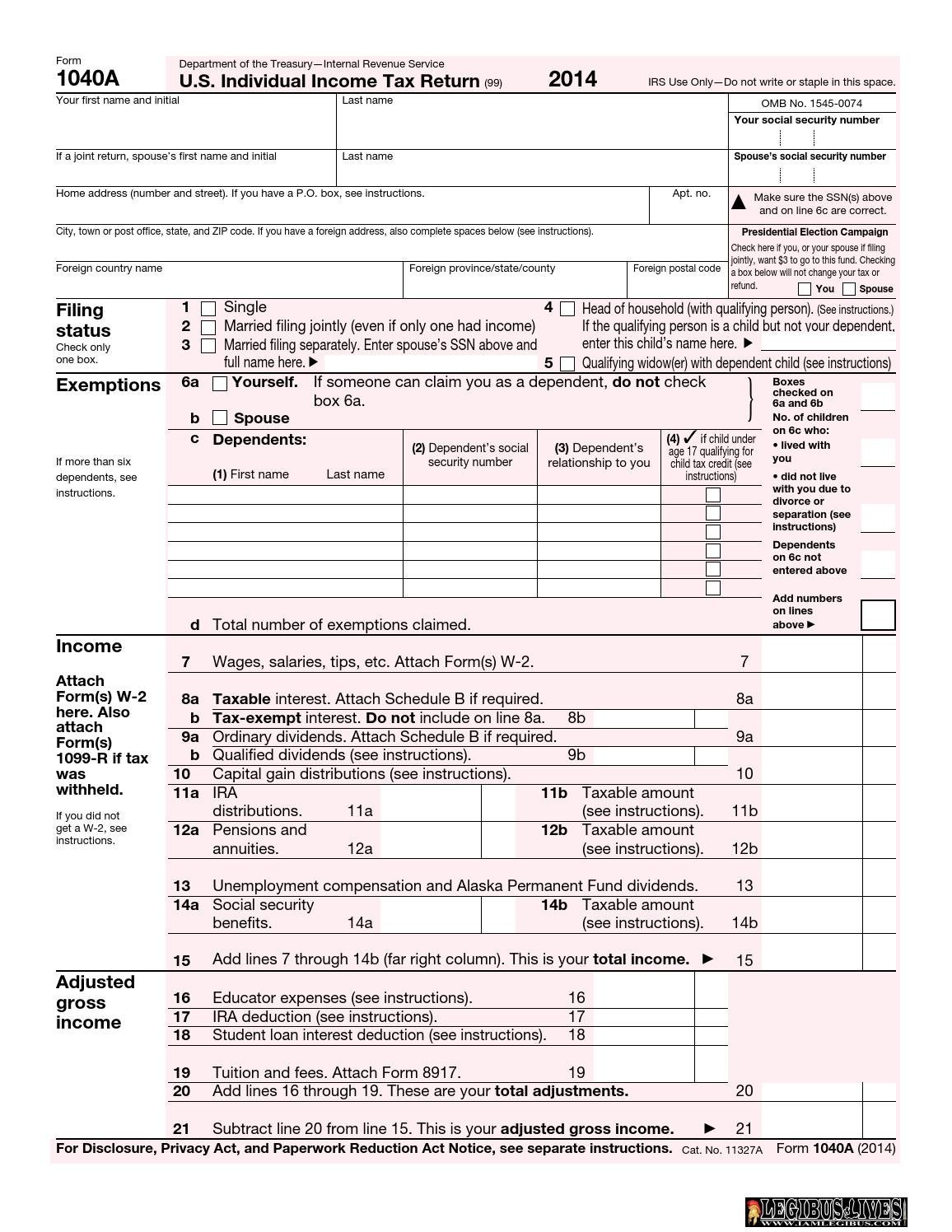

U S Individual Income Tax Return Forms Instructions Tax Table F1040a I1040a I1040tt By Legibus Inc Issuu

Https Apps Irs Gov App Vita Content Globalmedia 4491 Other Income Pdf

0 comments